Directors' Resolution for Dividend Distribution Template - Canada

Here's the template documents I frequently use for paying dividend distributions:

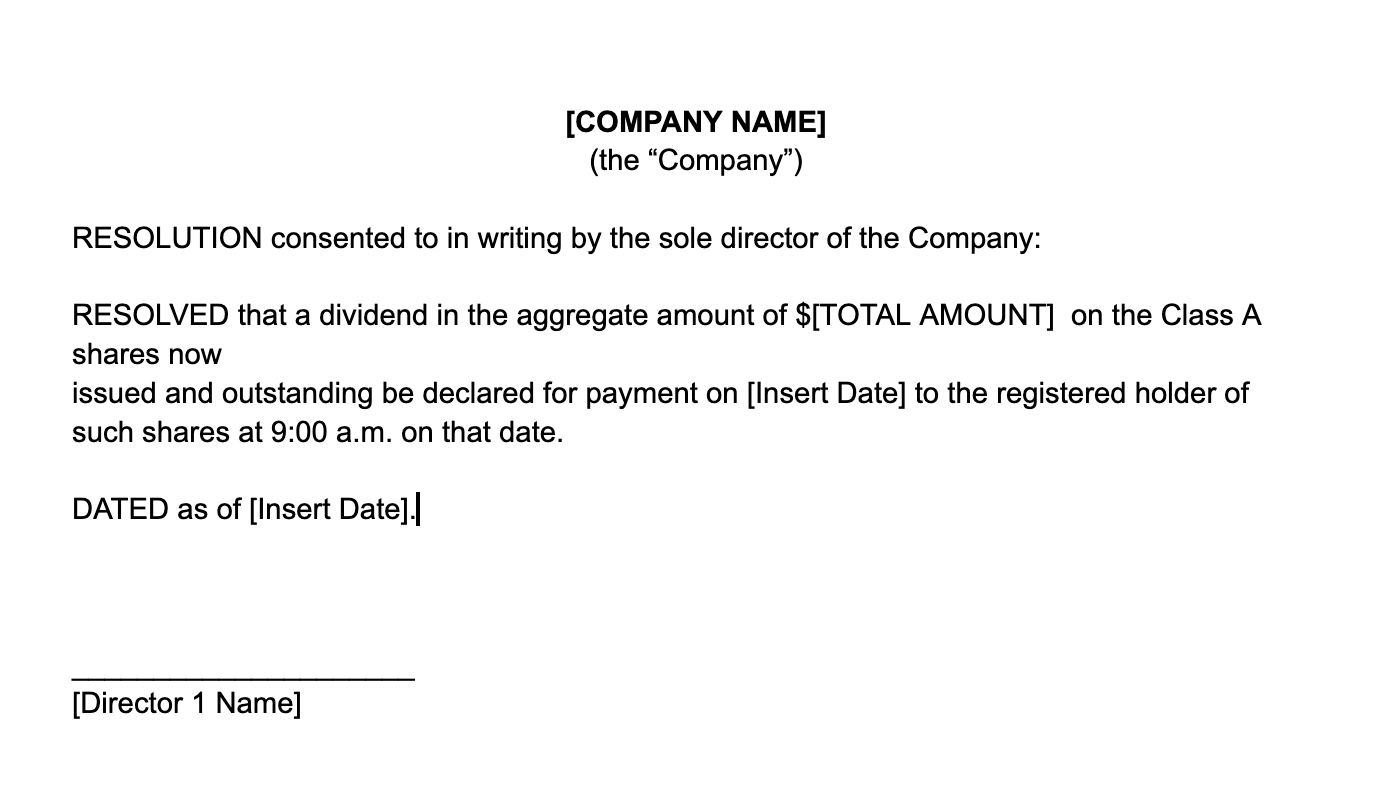

Sole Director:

Click to Make a Copy of the Director's Resolution for Dividend Distribution Template

Multiple Directors in a Company:

Click to Make a Copy of the Directors' Resolution for Dividend Distribution Template

Steps for paying out dividends to shareholders:

1. Check Your Money

- Make Sure You Have Enough: Before paying dividends, check if the company has enough profits or savings to pay out. The company should still have money left after paying.

2. Get Approval

- Write a Decision: The board of directors (or the sole director) needs to write down that they agree to pay the dividend. This is called a resolution.

- Agree to Pay: The directors or the sole director need to approve this decision.

3. Choose a Record Date

- Set the Date: Pick a date when shareholders must be listed in the company’s records to get the dividend. This is called the record date.

4. Set a Payment Date

- Decide When to Pay: Choose a date to actually pay the dividends to shareholders. This should be after the record date.

5. Tell Shareholders

- Send Notices: Let the shareholders know about the dividend, how much they’ll get, and when they’ll be paid.

- Keep Records: Write this decision down in the company’s official records.

6. Pay the Dividends

- Decide How to Pay: Choose how to give the money, like by check or direct deposit.

- Make Payments: Pay the dividends to the shareholders on the payment date.

7. Handle Tax Forms

- Issue Tax Forms: In the USA, companies may need to issue Form 1099-DIV to shareholders and report the dividends to the IRS. In Canada, T5 slips may be required for Canadian residents.

- File with Authorities: Make sure all required tax filings are completed on time.

8. Update Records

- Write Down Payments: Record the payments in the company’s books and update shareholder information.

- Check Finances: After paying, make sure the company still has enough money to operate.

9. End of Year Report

- Include in Reports: At the end of the year, show the dividend payments in the company’s financial reports.

Achieve Explosive Growth By Learning How to Build a Delegation-First Business

We hate SPAM. We will never sell your information, for any reason.